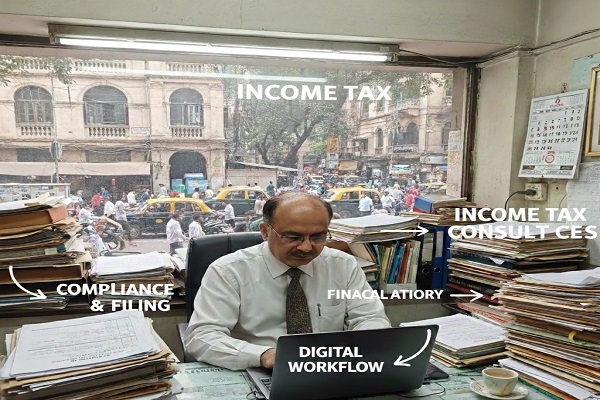

Income Tax Return Filing Services in Mumbai: Expert Solutions by Clientfirst Professional Services

Filing income tax returns is a critical task for individuals and businesses alike. Mistakes or delays in filing can result in penalties, interest, or even legal complications. To ensure accurate and timely submissions, professional Income Tax Return Filing Services in Mumbai are essential. At Clientfirst Professional Services, we offer expert guidance and comprehensive solutions to make tax return filing seamless and stress-free.

Why Professional Income Tax Return Filing Services in Mumbai Are Important

Navigating the Indian tax system can be complex due to frequent regulatory changes, multiple forms, and numerous deductions. Hiring professional Income Tax Return Filing Services in Mumbai provides several advantages:

- Accurate Filing: Avoid errors that could trigger notices or penalties.

- Maximize Refunds: Claim all eligible deductions and exemptions.

- Compliance Assurance: Ensure your returns meet all legal requirements.

- Expert Advice: Handle complex scenarios like business income, capital gains, and investments efficiently.

Clientfirst Professional Services ensures every client receives personalized attention to optimize tax savings while staying fully compliant with the law.

Services Offered by Clientfirst Professional Services

Our Income Tax Return Filing Services in Mumbai cover all aspects of tax management for individuals and businesses.

Individual Tax Return Filing

Filing personal income tax returns requires attention to detail and awareness of applicable exemptions. We provide:

- Tax return preparation for salaried employees

- Assistance for freelancers and self-employed professionals

- Support for senior citizens with unique exemptions

- Guidance on claiming deductions under sections like 80C, 80D, and others

With our assistance, individuals can file accurate returns on time, avoiding unnecessary stress or penalties.

Corporate Tax Return Filing

Businesses face additional challenges in tax filing, including corporate income tax, GST, TDS, and payroll compliance. Our services include:

- Corporate tax return preparation and submission

- GST compliance and advisory

- TDS calculation and reporting

- Audit assistance and regulatory compliance

Our team ensures that businesses stay compliant while maximizing tax efficiency.

Tax Planning and Advisory

Proactive tax planning is essential to minimize liabilities and enhance financial health. Our consultants provide advisory services that focus on:

- Investment planning to reduce taxable income

- Retirement planning and pension-related tax benefits

- Strategic advice for property and capital gains taxation

- Updates on tax law amendments to optimize returns

Effective tax planning with Clientfirst Professional Services ensures legal savings and financial growth.

Handling Tax Notices

Receiving a tax notice can be stressful for both individuals and businesses. Our Income Tax Return Filing Services in Mumbai include professional assistance to:

- Review notices and determine the required action

- Represent clients before tax authorities

- Respond to inquiries accurately and timely

- Resolve disputes in full compliance with the law

Our experts ensure that clients can navigate tax notices with confidence and peace of mind.

Advantages of Choosing Clientfirst Professional Services

Selecting the right Income Tax Return Filing Services in Mumbai ensures efficiency, accuracy, and peace of mind. Here’s why our clients trust Clientfirst Professional Services:

- Experienced Professionals: Years of experience handling diverse tax scenarios.

- Accurate and Timely Filing: Ensuring all returns are submitted correctly and on time.

- Personalized Approach: Tailored strategies for individual and business needs.

- Confidentiality: Secure handling of financial data with the highest standards.

- Reliable Support: Assistance available throughout the year, not just during filing season.

Our dedication to professionalism and quality service makes us a leading provider of tax return filing services in Mumbai.

Steps to Start Filing Your Income Tax Returns

Getting started with Clientfirst Professional Services is simple and convenient:

- Initial Consultation: Discuss your financial situation with our tax experts.

- Document Collection: Submit salary slips, Form 16, investment proofs, and bank statements.

- Data Review: Our consultants analyze your financial documents and recommend tax-saving strategies.

- Return Preparation and Filing: We prepare and file your returns accurately and efficiently.

- Post-Filing Support: Assistance with queries, audits, and notices after filing.

This structured approach ensures a smooth, stress-free experience for all clients.

Common Tips for Effective Tax Return Filing

Even when using professional services, understanding basic tax principles is important. Our experts recommend:

- Maintain organized financial records throughout the year.

- Claim all eligible deductions and exemptions.

- Regularly review tax liabilities, especially if income sources vary.

- Seek expert advice for complex scenarios such as capital gains or business income.

Following these tips with the guidance of Clientfirst Professional Services ensures optimized returns and compliance with tax laws.

Importance of Timely Tax Return Filing

Timely filing of tax returns is not just a legal requirement; it is also essential for financial planning. Late submissions can lead to penalties, interest, and scrutiny. Our Income Tax Return Filing Services in Mumbai help clients:

- Meet deadlines without stress

- Ensure all calculations are accurate

- Avoid penalties and interest

- Stay compliant with all regulatory requirements

Timely filing enhances peace of mind and maintains financial credibility.

Benefits of Professional Tax Assistance

Hiring professional consultants for tax return filing offers numerous advantages:

- Minimized risk of errors during filing

- Expert guidance on deductions, exemptions, and credits

- Ongoing financial and tax planning support

- Assistance with audits, notices, and compliance issues

Clientfirst Professional Services provides a seamless process, from document submission to post-filing support.

How Clientfirst Professional Services Makes a Difference

Our approach goes beyond basic tax return filing. We focus on:

- Customized Solutions: Personalized advice for both individuals and businesses.

- Advanced Tools: Technology-driven processes for accurate and faster filing.

- Regulatory Updates: Proactive compliance with the latest tax laws.

- Financial Guidance: Advice to reduce tax liability and plan investments strategically.

This comprehensive approach ensures that clients receive not only accurate filing but also strategic insights to improve their financial outcomes.

Conclusion

Accurate and timely tax return filing is critical for maintaining financial stability and compliance with the law. Professional Income Tax Return Filing Services in Mumbai ensure error-free filing, optimized deductions, and peace of mind. Clientfirst Professional Services offers expert guidance, personalized solutions, and reliable support for individuals and businesses across Mumbai.

From preparing precise returns to providing strategic tax planning and handling complex financial scenarios, our consultants make the entire process effortless. By choosing Clientfirst Professional Services, clients gain confidence in their tax management, financial security, and freedom from filing-related stress.

Take the first step toward stress-free tax return filing today by consulting our trusted Income Tax Return Filing Services in Mumbai. With Clientfirst Professional Services, your tax obligations are managed professionally, allowing you to focus on your personal and business growth.